Should You Panic Or Buy?

With Bitcoin dipping below the $65,000 mark, currently trading at $64,886, the cryptocurrency market is seeing a heightened sense of urgency among traders.

This latest drop reflects a broader trend seen over the past week, when Bitcoin shed about 2.4% of its value. The last 24 hours alone also fell by 1%, indicating growing market panic.

Related Reading

Should You Panic?

Analysts at the blockchain analysis platform Santiment highlighted the ongoing bearish phase as a sharp three-day decline in active Bitcoin wallets since peaking in early March, suggesting a major change in investor behavior and market sentiment.

However, this is in stark contrast to ETH, as Ethereum wallets continue to grow, showing a different investor confidence among the leading cryptocurrencies.

The increase in Ethereum wallets suggests a bullish outlook for ETH despite bearish pressure on Bitcoin. Meanwhile, according to Bitfinex analysts, the ongoing selloff has been heavily influenced by long-term Bitcoin holders and whales adjusting their holdings during the market consolidation phase.

This behavior is typical of long-term owners who choose to reduce their positions during periods of market uncertainty in order to make a profit or minimize losses.

A Bitfinex analyst revealed that the Hodler Net Position Change metric has shown negative values, indicating that these key players are moving their holdings to the exchange, potentially selling, pushing down Bitcoin prices.

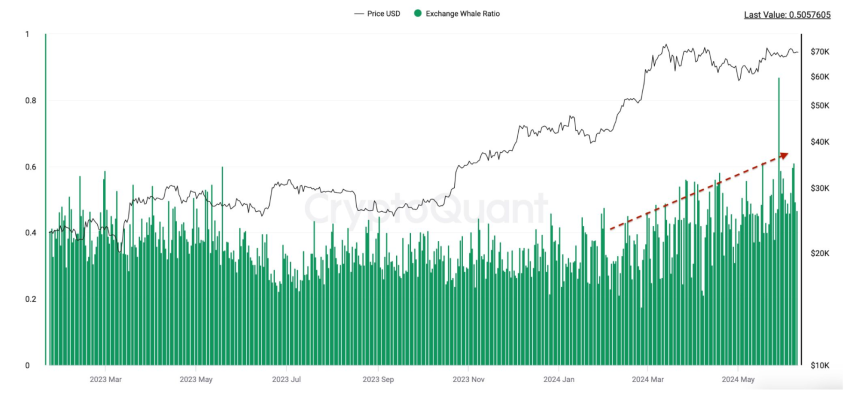

This trend is echoed by an increase in the Bitcoin Exchange Whale Ratio, which tracks large deposits on exchanges relative to overall market activity.

As more whales transfer their Bitcoin to trade on platforms, a possible increase in the market could lead to a drop in price.

Should You Buy?

Despite these pressures, some analysts remain cautiously optimistic about a potential rebound. CrediBULL Crypto, a prominent analyst, suggested at X it is possible that BTC is approaching its lowest support levels, and the current prices may continue the deep market lower that many fear.

There is an opportunity, folks $BTC down there is this SFP.

Below is what I am looking at now.

Yes, we can still technically drop into the “long dream” zone below, but as I’ve said before I wouldn’t be surprised to see that front run.

That being said, you sell… pic.twitter.com/cI6moqbadJ

– CrediBULL Crypto (@CredibleCrypto) June 18, 2024

Funding prices in the crypto derivatives market serve as an important indicator of trader sentiment. The latest data from Coinglass shows that the currency rates are slightly positive, which usually indicates a bullish sentiment among traders.

Related Reading

Notably, funding levels mean that many traders are betting on the price of Bitcoin going up and are willing to pay a premium to hold long positions in futures contracts.

Support levels are slightly positive, indicating that it is bullish.

Buy the dip.

– CoinGlass (@coinglass_com) June 18, 2024

This metric can often go against the prevailing market sentiment, suggesting that despite the sell-off, part of the market is preparing for a potential price hike.

The featured image was created with DALL-E, a Chart from TradingView