Ethereum Suffers 3rd Straight Weekly Outage

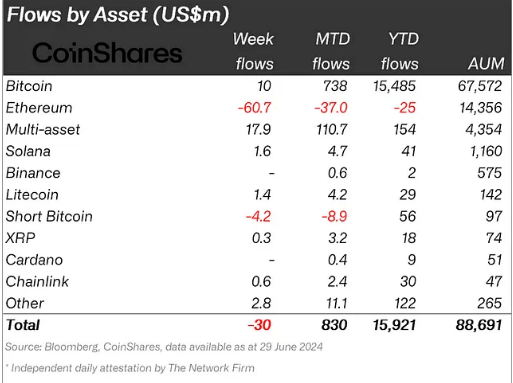

The digital asset market is facing a wave of investor caution, with Ethereum leading the way. CoinShares reports show a third consecutive week of outflows, with Ether sustaining the heaviest losses. This negative outlook on top altcoins, coupled with sluggish trading volume and regional volatility across the market, paints a picture of a market that is looking for direction.

Related Reading

Ethereum Faces Heartbreak Despite Upcoming Milestone

Ethereum, the world’s second-largest cryptocurrency, has seen the worst outflow of any digital asset this year, reaching $61 million last week. The negative figure can be attributed to the delay in the approval of the Ethereum ETF, a highly anticipated event that has been in the works for almost three years.

According to CoinShares, digital asset investment products saw $30 million in outflows last week, the third consecutive week of outflows. Ethereum saw its largest outflow since August 2022, totaling $61 million, making it the worst-performing digital asset investment product…

– Wu Blockchain (@WuBlockchain) July 1, 2024

Waiting too long for regulatory green light may cause investors to stop committing, creating uncertainty in the Ethereum market. However, the upcoming launch on July 4 is still an important moment. Analysts are watching to see if this long-awaited development sparks a surge in Ethereum adoption or simply eats away at Bitcoin ETF investments.

Mixed Signals: Regional Divergence and Altcoin Interest

While the overall trend points to caution, there are regional differences in investor sentiment. The United States, for example, defied the global trend and saw an inflow of 43 million dollars, suggesting the continued interest of the United States in the area of digital assets.

Similarly, the influx of more commodities and Bitcoin Exchange-Traded Products (ETPs) reflects the preference for diversification and established players. This highlights the continued appeal of broad exposure to the digital asset space, rather than a singular focus on any one cryptocurrency.

Interestingly, in the midst of Ethereum’s exit woes, other altcoins are experiencing a resurgence. Solana and Litecoin, for example, have seen inflows, suggesting that investors are looking for opportunities beyond the top two cryptocurrencies. This diversity may be a sign of a growing market where investors are assessing risk and evaluating undervalued assets within the larger digital asset system.

Related Reading

Navigating Uncertain Waters

The current state of the digital goods market is one of cautious optimism. While Ethereum’s exits and struggles are undeniably worrying, positive entry into certain areas and products provides a counterpoint.

The upcoming launch of the Ethereum ETF is a wild card, which may act as a catalyst for further adoption or simply to restructure existing investments. Investors are likely to remain cautious in the near future, carefully weighing risk and reward before making significant commitments.

Featured image from parent, chart from TradingView