Almost $200 Million Liquidated as Bitcoin Slips Below $61,000

In a tumultuous 24-hour trading session, the cryptocurrency market saw nearly $200 million liquidated in cash as the price of Bitcoin fell below $61,000. This sharp decline caused a wave of liquidations, affecting many investors and traders.

Market Meltdown and Crypto Liquidation

Total market capitalization fell by about 2.7% to about $2.34 trillion, underscoring high volatility and market stress.

Related Reading

Bitcoin, which led the decline, shed 1.3% during the week, with a 2.8% decline recorded in the last day. This decline not only reduced the value of many investors’ portfolios but also led to heavy losses for traders through closures.

Data from Coinglass highlights the level of carnage, as 59,816 traders were eliminated and the total elimination amounted to $170.72 million.

The closings were from long positions, suggesting that many traders expect the market to rally. Bitcoin sellers faced a closing of $45.76 million, while Ethereum and Solana sellers received $44.55 million and $11.09 million, respectively.

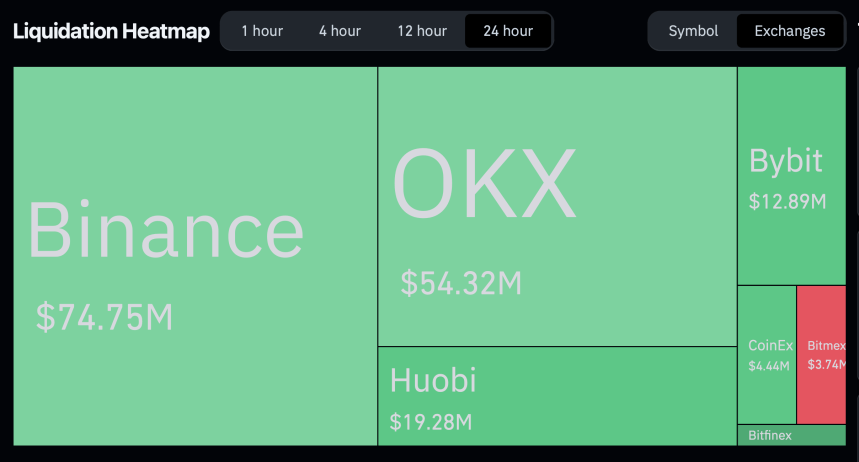

The platform for this closure was in large places such as Binance, OKX, Huobi, and Bybit, Binance traders were burdened with $ 74.77 million.

While other exchanges such as OKX, Huobi, and Bybit also experienced significant liquidation, amounting to $54.29 million, $19.28 million, and $12.93 million, respectively. Despite facing liquidation, small exchanges had relatively little impact.

Analysts’ Opinion on Bitcoin’s Current Performance

Despite the current downturn, some market analysts remain optimistic about Bitcoin’s prospects. PlanB, a respected figure in the crypto community, has also confirmed that the bull market is still ongoing, suggesting that off-chain metrics are not showing any anomalies that would indicate a long bear market.

Related Reading

Additionally, crypto analyst Ali recently suggested on Elon Musk’s social media, X, that now might be a good time to buy Bitcoin, waiting for the market to come back.

TD Sequential, told us to buy #Bitcoin for $60,000 on June 28 and sold for $63,200 on July 1, telling us to buy $BTC again! pic.twitter.com/JJzQtVJcBh

– Ali (@ali_charts) July 3, 2024

In addition, vocal Bitcoin advocate Samson Mow has emphasized Bitcoin’s importance in addressing underlying economic problems, suggesting that fixing financial systems could be key to broader economic recovery.

Governments cannot fix the economy because the money is corrupt. You have to prepare the money first. #Bitcoin

— Samson Mow (@Excellion) July 3, 2024

His views highlight the potential of Bitcoin not only to restore but also to reach new heights in the financial world.

The featured image was created with DALL-E, a Chart from TradingView