Altcoins Defy Trends As Bitcoin Faces $600M In Outflows – What’s Next?

The Bitcoin market has seen significant changes recently, influenced by macroeconomic factors and changing investor sentiment. Last week, digital asset investment products saw a huge outflow, which CoinShares attributed to several key economic updates.

This includes the release of US CPI data, the Federal Open Market Committee (FOMC) meeting, and Producer Price Index (PPI) figures. These events appeared to trigger a rapid increase in the price of Bitcoin, pushing it slowly towards the $70,000 mark before a quick decline corrected the valuation back to around $65,000.

Related Reading

Market Changes: BTC Faces Massive Exodus While Other Altcoins Attract Investment

So far, this Bitcoin price volatility is part of a broader pattern of volatility that has marked the digital currency market. In the past week alone, institutional and retail investors have withdrawn nearly $600 million from cryptocurrencies, marking a major reversal.

CoinShares suggests that this may reflect a growing trend of caution, fueled by the “hawkish mood” at the recent FOMC meeting, which may encourage investors to reduce their exposure to volatile assets such as cryptocurrencies.

Bitcoin, which was particularly hard hit, experienced outflows of up to $621 million. Despite this, there was a silver lining as altcoins like Ethereum, Litecoin, and others saw little inflow. Ethereum led the way with an increase of $13 million, suggesting a different investor confidence in altcoins compared to Bitcoin.

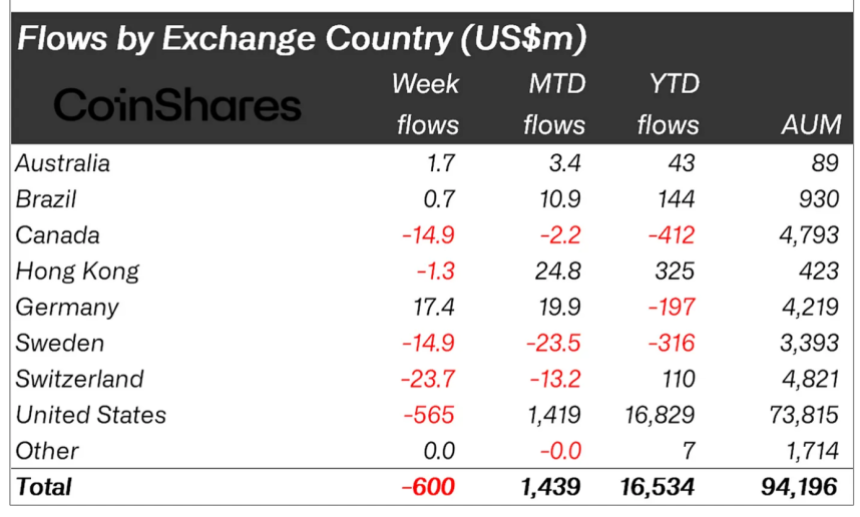

The situation reflects a mixed outlook where Bitcoin is struggling under selling pressure while selected altcoins are gaining less traction. Meanwhile, the overall impact on the market is visible, with assets under management falling from more than $100 billion to $94 billion within a week.

Trading volumes are also down significantly from their annual average, reflecting a cautious approach by traders across the board. Regionally, while the US has experienced an outflow, countries such as Germany have seen inflows, suggesting a mixed global response to the current economic climate.

Bitcoin ETFs See Mixed Fortunes

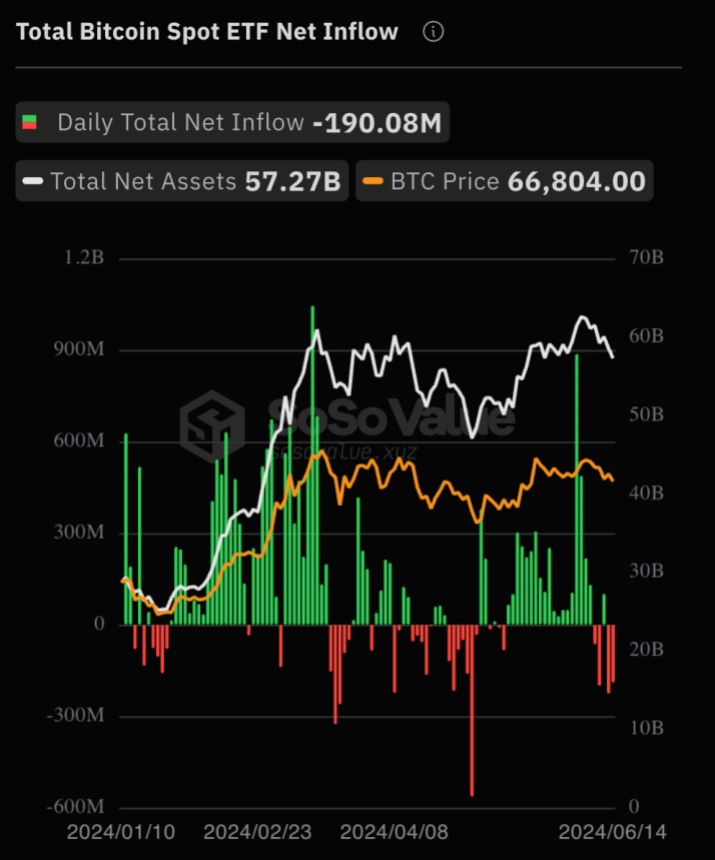

Despite a strong increase in net inflows to US spot Bitcoin exchange-traded funds (ETFs), which reached $15.11 billion in recent weeks, the sector experienced a decline last week with net outflows of $190 million per day, based on data from SoSoValue .

Regarding the performance of the market, the price of Bitcoin has fallen significantly, hitting less than $ 65,398 last Friday. However, as of today, the price of Bitcoin has returned to $65,552, although it still shows a decrease of 1.1% in the previous day and 5.5% during the week.

Speaking on Bitcoin ETFs, BlackRock’s Chief Investment Officer, Samara Cohen, has noted a slow but steady interest in them despite their slower-than-expected adoption.

According to Cohen, currently, the majority of Bitcoin ETF transactions, about 80%, are conducted by “self-directed investors” using online brokerage platforms.

Cohen added that the iShares Bitcoin Trust (IBIT) is one of the ETFs launched this year, attracting attention from individual investors and hedge funds and brokerages, as shown in the latest 13-F filing.

Related Reading

However, the participation of registered investment advisors remains relatively low, Cohen discussed during the recent Crypto Summit.

The featured image was created with DALL-E, a Chart from TradingView

Source link