Bitcoin Futures-to-Spot Volume Ratio Down 63% This Bull Run

The data shows that the average trading volume of Bitcoin futures to spot is down 63% from the height of the last bull market. Here’s what it says.

Bitcoin Futures Market Using Low Volume Shares This Rally

As explained by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the BTC market appeared to be less future driven than it was during the previous bull run.

The metric of interest here is the “futures to spot trading volume ratio,” which, as its name suggests, tracks the ratio between Bitcoin futures and spot trading volumes.

Trading volume naturally refers to the ratio of the total amount of crypto currency involved in trading on various exchanges in the sector.

If the ratio is high, the futures market sees more trading volume than the spot. Similarly, low prices mean dominance of the exchange in the area.

Now, here is a chart showing the trend of the average Bitcoin futures trading volume to spot over the past few years:

The value of the metric appears to have been moving sideways in the last few months | Source: @ki_young_ju on X

The graph above shows that the average Bitcoin futures trading volume to spot has risen to record highs during the 2021 bull run. Specifically, the index broke more than 12 marks during its peak, which means that the futures volume exceeded the local trade more than a dozen times.

Following this high, the metric declined during the second half of the 2021 bull run, but remained at a high level. These higher rates then continue into the first half of 2022.

As the decline of bear markets was approaching, however, the metric had gone down, as interest in speculative activities about cryptocurrency had ended. With the resumption of 2023, the index saw some revival and touched the same levels as the first half of 2022 in mid-June.

Since then, however, the ratio has dropped back to low levels and has continued to rally toward them until now. Compared to the peak of 2021, the value of the index has fallen by almost 63%.

Futures trading volume is still a major force in the market, but it’s much smaller than in 2021, meaning speculative interest has been tepid compared to the rally. The founder of CryptoQuant believes that this development reaching a high trading volume in the area will be good for the market.

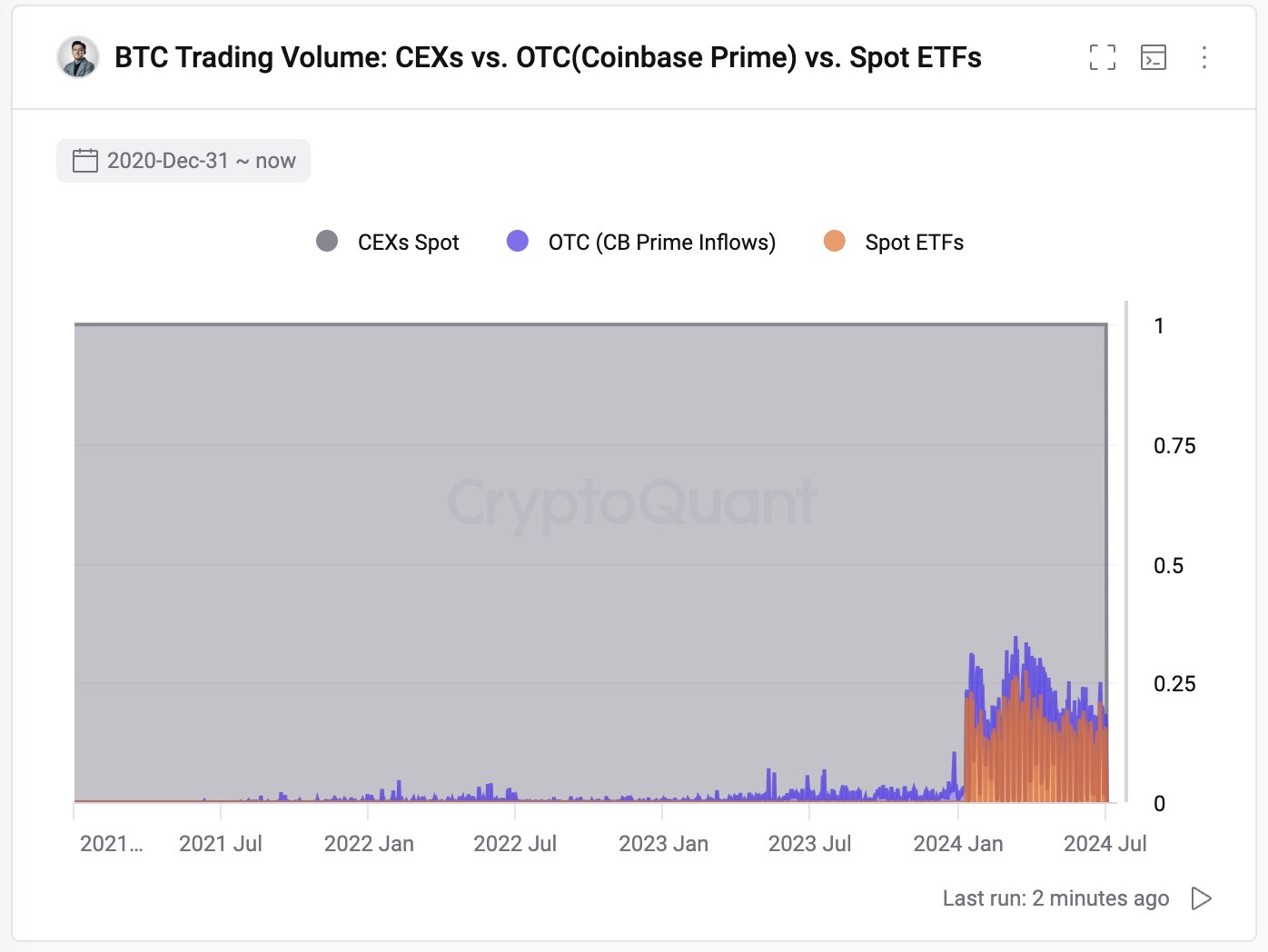

In this latest cycle, however, there is an exception: the emergence of a new way to trade Bitcoin: exchange-traded funds (ETFs). So, how does the volume of these financial instruments compare to the local market?

As Ju pointed out in X’s other post, these ETFs currently make up about a quarter of the area’s total trading volume.

The ETF volume of BTC stacked against its spot trading volume | Source: @ki_young_ju on X

BTC price

Bitcoin has suffered a drop of more than 4% in the past 24 hours, taking its value to $57,300.

Looks like the price of the coin has been going downhill in recent days | Source: BTCUSD on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Source link