Bitcoin Investors Abandon Greed After Crash Below $61,000

The data shows sentiment among Bitcoin investors has moved out of the greed zone following the asset’s recent crash below $61,000.

The Bitcoin Fear & Greed Index Now Sits Inside the Intermediate Region

The “Fear and Greed Index” is an indicator created by another method that tells us about the average sentiment of Bitcoin traders and the share of the broader cryptocurrency market at the moment.

This index considers data from five factors to determine this sentiment: volatility, trading volume, social media sentiment, market dominance, and Google Trends.

To represent emotions, the index uses a scale from zero to great. All values below the 47 mark suggest the presence of fear among investors, while those above 53 indicate greed in the market.

The region is between these two areas and is naturally neutral. The Bitcoin Fear & Greed Index appears to be within this third area.

The value of the metric seems to be 51 at the moment | Source: Alternative

As seen above, the Fear & Greed Index is currently 51. This is a significant change from the figure of 55 seen yesterday, as the market was holding a greedy sentiment at that time.

The worsening mood is because cryptocurrency prices have faced strong bearish momentum in the past 24 hours. This decline in the metric is in line with the trend of the previous week, as the recent drop in the stock is a continuation of the recent bearish trend.

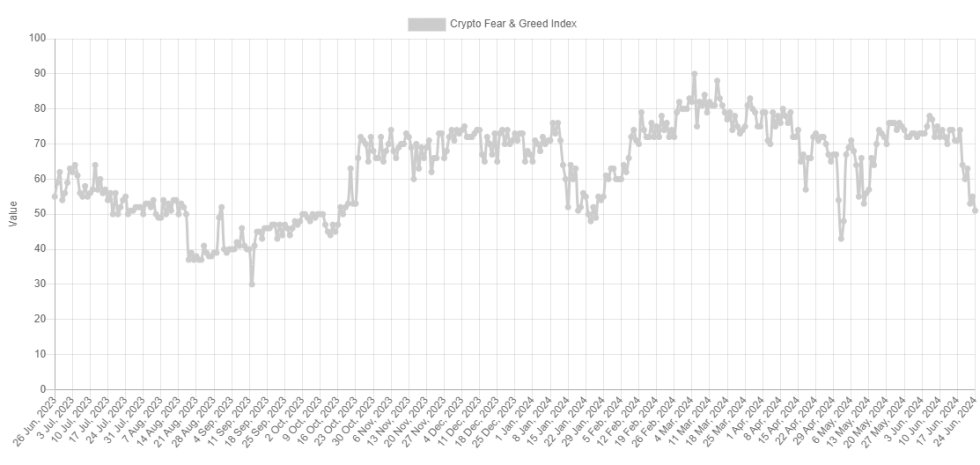

The chart below shows how the Bitcoin Fear & Greed Index has seen its value change over the past year.

Looks like the value of the metric has been sharply going down in recent days | Source: Alternative

As can be seen in the graph, the recent drop in the Bitcoin Fear & Greed Index has been very sharp. On June 18, at the beginning of this decline, the metric had a value of 74, which was deep in greedy territory.

This number was right on the edge of the “normal” greed region, since above 75, the indicator begins to show the presence of “extreme greed” among investors. Historically, this region has been very important to cryptocurrency.

This is because the price of the asset tends to move against the expectations of the majority, and the higher the probability that this is the opposite, the stronger these expectations become.

In the case of extreme greed, investors are happy; therefore, the higher the load the more likely it is to occur. The stock’s all-time high (ATH) back in March also occurred while the index was in this region.

While extreme greed can lead to an asset correction, “extreme fear,” which occurs below 25, can help the cryptocurrency reach the bottom instead. However, the indicator often stays in or near the greedy region during bull markets.

Therefore, although the sentiment has never been so bad in extreme fear or even in the area of fear with the recent dip, the fact that it has cooled to the middle can still be a sign of hope that the coin has reached the end of its decline, considering the bullish trend remains a strong force in the long term.

BTC price

At the time of writing, Bitcoin is floating around $60,300, down more than 10% in the last week.

The price of the coin appears to have seen a steep drop in the past day | Source: BTCUSD on TradingView

Featured image from Dall-E, Alternative.me, chart from TradingView.com

Source link