Here Are 2 Things That Must Happen For BTC To Break $72,000

By local standards, Bitcoin is strong, but traders doubt the rise following the unexpected rejection on June 11. Currently, Bitcoin is stable, trending above $ 67,000 and lower despite the gains on June 12.

Nevertheless, even at this level, there is concern because the coin, despite all the confidence across the board, remains below $72,000. This line of reaction appears as the main point of closure. If broken, BTC can release a temporary closing wave, accelerating the lift-off to $74,000 and above.

Will Bitcoin Demand Increase in Spot Markets?

It takes on X, the only on-chain analyst said that Bitcoin is languishing at levels below $72,000 because hedge funds are short futures.

Related Reading: Solana On-Chain Indicators Suggest A Return Of Bullish Sentiment, Is It Time To Buy SOL?

Although this has been a known development for a while, hedge funds placed their BTC shorts on the Chicago Mercantile Exchange (CME) over $1 billion last week alone.

Therefore, the analyst says two things must happen to reverse this effect and support prices. Although the lack of BTC on CME is not a bearish signal, hedge funds are being lured by playing a complex arbitrage strategy, and coin holders should look at the fundamentals.

Hedge funds are shorting BTC futures on the CME and buying in the market. Therefore, for the coin to break $72,000 and stab at $74,000, the analyst said that users should buy at least 2X the value of the shorted BTC futures in the local market.

BTC Prices Must Fall For Short Sellers To Exit

If there is no incentive to raise prices higher, then Bitcoin prices should fall. Falling prices will encourage short sellers, in this case, hedge funds, to exit their positions lest they continue to pay cash prices. In a bearish market, and when futures prices begin to decline, short sellers must pay long so that the index does not deviate.

Whether there will be an increase in demand in the market remains to be seen. However, what is clear is that institutional interest in Bitcoin exists, only those hedge funds, as seen in their arbitrage trading using CME, want to make a profit, regardless of price movements.

Related Reading

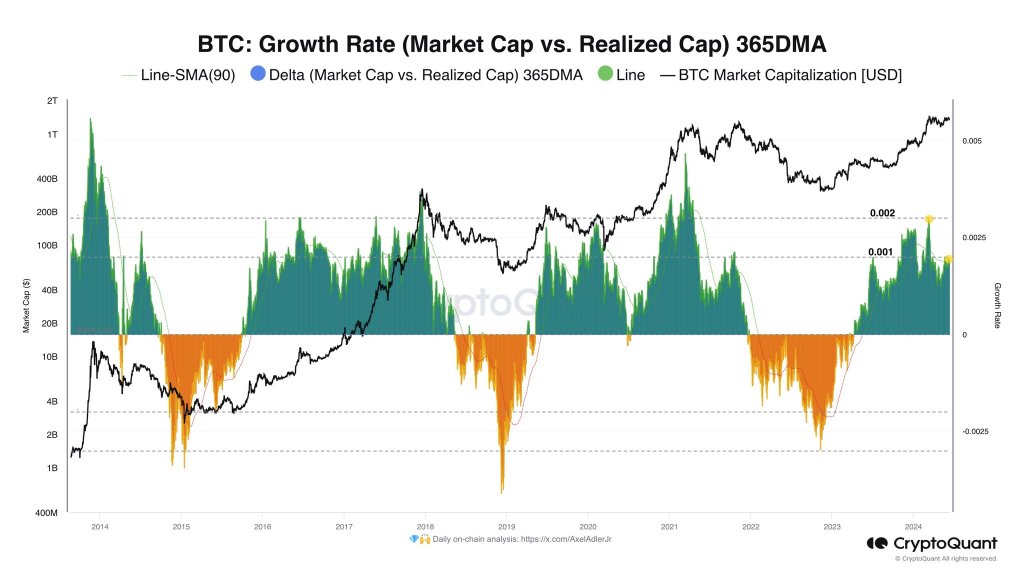

Commentator too shared another chart to reinforce the bullish view. The trader used the “Growth Rate” to compare the changes in the Bitcoin market and noticed the cap.

Currently, the metric is around 0.001, less than 0.002, which means the market may be overheated. The Bulls may be preparing for a comeback.

Insert image from DALLE, chart from TradingView

Source link