Fidelity’s Senior Analyst Explains the Future of Wealth Storage

Fidelity’s Director of Global Macro, Jurrien Timmer, recently commented on the debate over whether Bitcoin or gold is the most reliable store of value, explaining the circumstances in which each of these asset classes can or cannot weather inflation based on the state of the economy. .

Theory of Money Supply and Asset Valuation

Timmer’s thinking is built on the concept of “monetary rule,” where a government moves to expand the money supply, threatening the purchasing power of a currency. He notes job inflation, as confirmed by the historical M2/CPI money supply.

And while BTC and gold are arguably the most inflation-resistant assets based on theory, Timmer believes that such a scenario should have fully materialized, even after the recent Federal Reserve fraud.

In addition, due to the love of flexibility, Bitcoin is also called “digital gold,” “gold 2.0,” and “virtual gold” because, on the other hand, Bitcoin has all the monetary properties that gold has. However, it is also a new Internet technology, according to Timmer.

However, in order for Bitcoin to enter and maintain its place with gold, fiat currency rates will need to continue to grow at rates well above normal trends.

While there was a spike in M2 money supply during the recent crisis, the tightening of monetary policy by the Federal Reserve made it temporary, according to Timmer. This suggests that gold and Bitcoin may be premature in their roles as absolute stores of value.

Currently, the price of Bitcoin has risen to $69,523, following the latest CPI report showing a decrease in inflation, which may suggest a strengthening of its status as a store of value.

This report also reflected positively on the price of gold as the commodity could see an increase of 0.91% in the last 24 hours at the current trading price of $2,336.

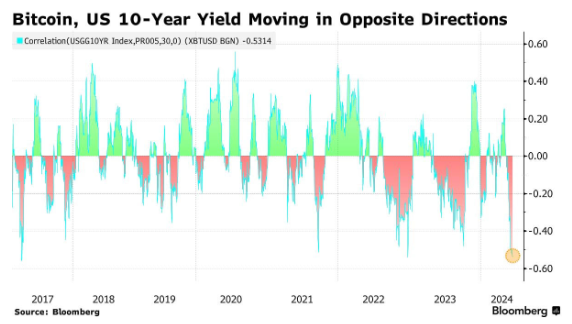

Treasury Yield Correlations Effects on Bitcoin

Meanwhile, according to the latest information reported by Barchart, the price of Bitcoin (BTC) has lost its correlation with the yield of the 10-year US Treasury bond (UST) as the correlation has fallen to the lowest level in the last 14 years, equal to – 53.

The split shows that BTC is now moving independently, without the market being swayed by conventional financial instruments such as the yield on Treasury bonds. This metric determines the yield of investors in government securities.

This may suggest that Bitcoin is becoming more entrenched in traditional financial systems, which may be the beginning of its evolution from being lumped into its own unique asset class.

If Bitcoin continues to diverge from these traditional financial metrics, it could greatly improve its status as the best non-traditional hedge against financial volatility.

However, the general limitations of Bitcoin and gold as stores of value, Timmer admits, are based on economic conditions that are yet to play out, especially where money supply and inflation are concerned.

The featured image was created with DALL-E, a Chart from TradingView

Source link